© Business Strategy Planning and Templates - iPlanner.RBL Bank, says he is hopeful that in fourth quarter 2019, they should be able to exit at a higher ROA than now and at approximately 13.5% ROE, a significant improvement over today.Ĭongratulations for an excellent quarter. Published by iPlanner.NET | << Back to Collection of How-to Guides Planning process can be an invaluable tool to improving business performance. Adding financial ratios into the financial

These figures can illuminate unforeseen problems in a company and can Also, ratios may help you to justify decisions when you are buying or selling a business. Using these ratios is the first step to taking a deep look into the financials of a business. Indicate strong sales or the need to increase inventory levels. Turnover indicates excess inventory and perhaps low sales. This ratio shows how many days inventory a company has on hand. Inventory Turnover = 365 / (Cost of Goods Sold / Average Inventory) Wants to have flexible payment terms to allow liquidity but does not want to Optimum number of days payable varies by company and by industry. This ratio indicates how long a company takes to pay suppliers and vendors. That a company is efficiently managing its accounts receivable process.ĭays Payable Outstanding = Accounts Payable / Cost of Sales x Number of Days A lower number of days receivable indicates This ratio provides the average number of days that it takes for a company to Receivables Collection Period = (Days x Accounts Receivable) / Credit Sales. On a company’s industry and financial health. The appropriate debt to equity ratio depends Illustrates that a company is highly levered, or that it carries a lot of debt This ratio indicates how levered a company is. A high DSCR ratio indicates that a company hasĮnough cash flow to cover debt obligations.ĭebt to Equity Ratio = (Total Liabilities / Shareholder’s Equity) In some cases, Operating Cash Flow is substituted for Net High ISCR ratio means that a company is well-prepared to pay its upcomingĭSCR (Debt-Service Coverage Ratio) = Net Operating Income / Total DebtĭSCR measures the cash available to meet debt payments, including principal and ISCR indicates how much cash a company has to pay interest on its debt. ISCR (Interest-Service Coverage Ratio) = Net Operating Income / Interest Over a short period of time to generate cash. Ratio includes inventories in current assets, because inventories can be sold More forward-looking than the quick ratio unlike the quick ratio, the current

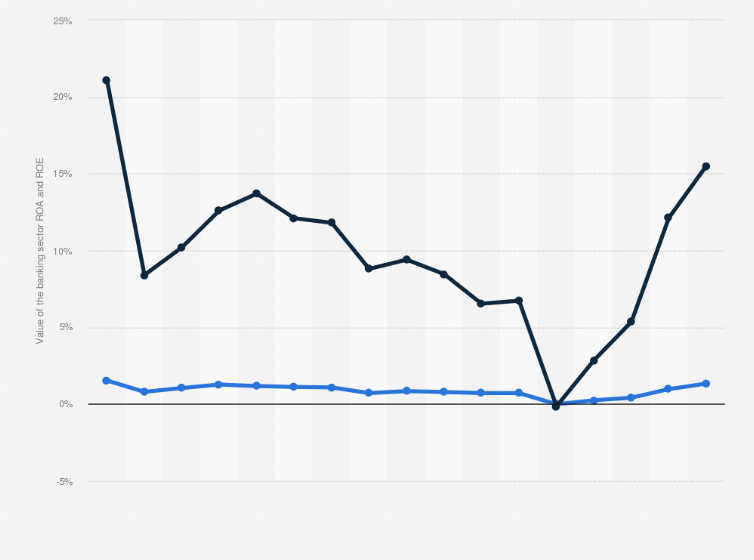

The current ratio is another measure of liquidity. More liquid assets a company has to meet immediate financial obligations.Ĭurrent Ratio = (Current Assets / Current Liabilities) The quick ratio measures the liquidity of a company. Quick Ratio = (Current Assets – Inventories) / Current Liabilities High ROA indicates that management is effectively utilizing the company’s This ratio measures how profitable a company is relative to its total assets. ROA (Return on Assets) = Net Income / Total Assets. This ratio measures how much profit the shareholder’s investment has generated.Ī higher ROE percentage indicates that shareholders are receiving a better

ROE (Return on Equity) = Net Income / Shareholder’s Equity. Higher this ratio is, the more revenue the company has to pay off other Pays all of the direct costs associated with generating that revenue. Gross margin is a representation of how much revenue remains after a company Gross Margin = (Revenue – Cost of Goods Sold) / Revenue Operating margin is a sign that a business might not have enough revenue to pay Operating expenses, such as employee salaries and raw material costs. This ratio shows how much of a company’s revenue is left after paying off all Operating Margin = Operating Income / Net Sales Below areĮxplanations of some of the most common financial ratios. To all businesses and some of which are industry-specific. There are hundreds of financial ratios available, some of which apply It is important to choose financial ratios that are applicable to the businessĪt hand.

Selling a Business? ExitAdviser is a guided platform to fast-tracking your business sale.

0 kommentar(er)

0 kommentar(er)